kvant-rzn.ru

Overview

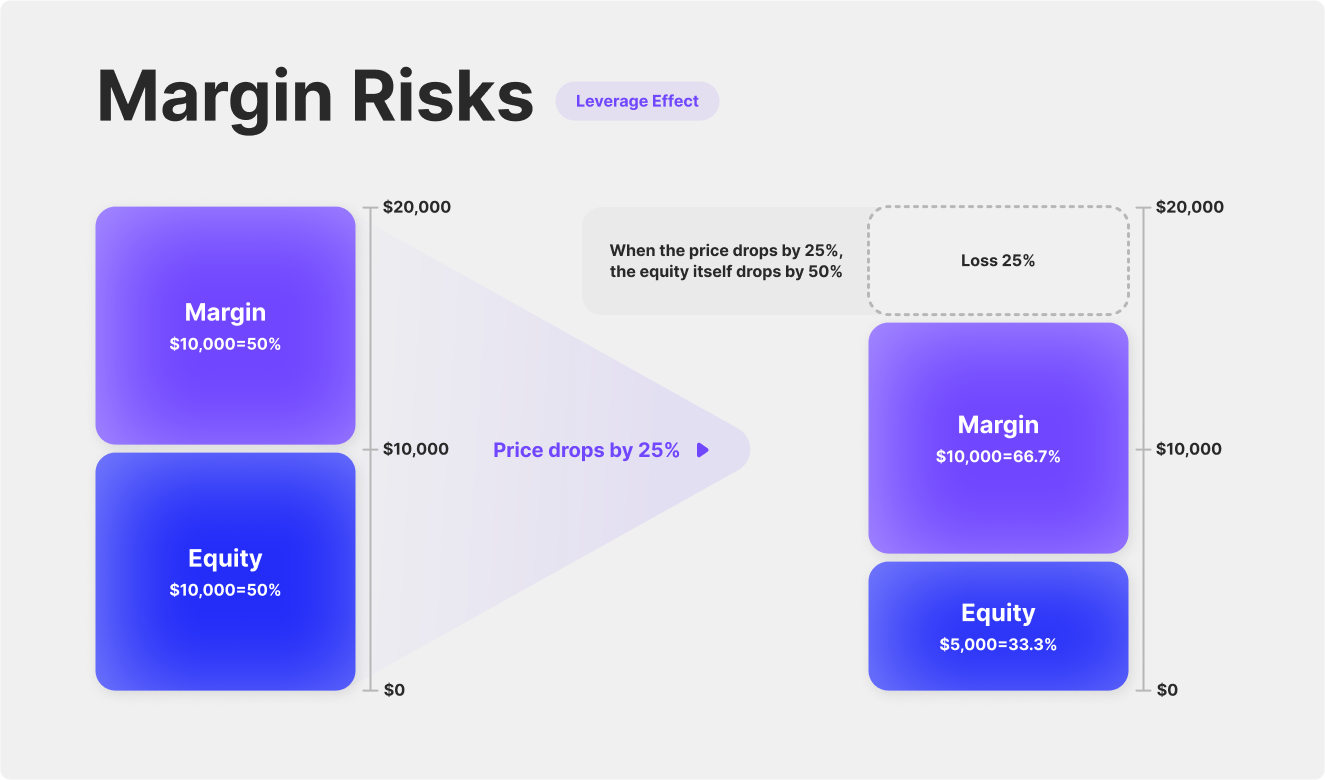

Margin Ratio Trading

Margin is the amount of money needed to open a position, while leverage means that you can enter into positions larger than your account balance. Most margin requirements are calculated based on a customer's securities positions at the end of the trading day. A customer who only day trades doesn't have a. Brokerage customers who sign a margin agreement can generally borrow up to 50% of the purchase price of new marginable investments. Customer margin ratio shall be 50% or more, of which cash shall consist 20% or more. Modalis Therapeutics Corporation, , Aug. 19, , Customer margin. Margin Trading. The most general definition of margin, one covering both buying and shorting securities, is the ratio of the equity of the account divided by. In finance, margin is the collateral that a holder of a financial instrument has to deposit with a counterparty to cover some or all of the credit risk the. Margin trading is the practice of using borrowed funds from brokers to trade financial assets; this essentially means investing with borrowed money. Usually. While a margin amount of only 1/50th of the actual trade size is required from the trader to open this trade, any profit or loss on the trade would correspond. A Margin Requirement is the percentage of marginable securities that an investor must pay for with his/her own cash. Margin is the amount of money needed to open a position, while leverage means that you can enter into positions larger than your account balance. Most margin requirements are calculated based on a customer's securities positions at the end of the trading day. A customer who only day trades doesn't have a. Brokerage customers who sign a margin agreement can generally borrow up to 50% of the purchase price of new marginable investments. Customer margin ratio shall be 50% or more, of which cash shall consist 20% or more. Modalis Therapeutics Corporation, , Aug. 19, , Customer margin. Margin Trading. The most general definition of margin, one covering both buying and shorting securities, is the ratio of the equity of the account divided by. In finance, margin is the collateral that a holder of a financial instrument has to deposit with a counterparty to cover some or all of the credit risk the. Margin trading is the practice of using borrowed funds from brokers to trade financial assets; this essentially means investing with borrowed money. Usually. While a margin amount of only 1/50th of the actual trade size is required from the trader to open this trade, any profit or loss on the trade would correspond. A Margin Requirement is the percentage of marginable securities that an investor must pay for with his/her own cash.

The leverage ratio and margin requirements differ from broker to broker. The amounts typically offered are , and The leverage offered will also. MetaTrader 4 accounts can be reduced to and Keep in mind that increased leverage increases risk. Please fill out a Margin Change Request Form and. A margin account is an account with a broker where a trader deposits their funds for later use in Forex trading. Funds on a margin Forex trading account serve. The margin level calculation is expressed as a percentage: (equity / margin) x It's helpful to think of margin level as a reading of your trading account's. Margin trading is when you pay only a certain percentage, or margin, of your investment cost, while borrowing the rest of the money you need from your broker. In simple terms, margin means borrowing money from your brokerage by offering eligible securities as collateral. In more specific terms, margin refers to the. When you trade on margin, you can leverage the funds in your account to potentially generate large profits relative to the amount invested. The downside of. A Margin Requirement is the percentage of marginable securities that an investor must pay for with his/her own cash. The maximum leverage ratio calculates financial leverage if the trader's equity position is equal to the initial margin requirement. Securities margin is the money you borrow as a partial down payment, up to 50% of the purchase price, to buy and own a stock, bond, or ETF. Margin trading enables traders to increase their exposure to the market. This means both profits and losses are amplified. Margin Ratio (in %) measures the availability of account net equity to maintain the required margin. The higher the margin ratio is maintained, the lower the. Forex margin rates are usually expressed as a percentage, with forex margin requirements typically starting at around % in the UK for major foreign. Margin in trading is the deposit required to open and maintain a leveraged position using products such as CFDs and spread bets. Here's an example: Suppose you use $5, in cash and borrow $5, on margin to buy a total of $10, in stock. If the stock rises in value to $11, and you. For example, if your broker has an initial margin requirement of 60% for a stock and you want to buy a stock worth $, your margin will be $ and the. (5) The minimum maintenance margin levels for security futures contracts, "long" and "short", shall be 20 percent of the current market value of such contract. Leverage allows you to trade positions LARGER than the amount of money in your trading account. Leverage is expressed as a ratio. Leverage is the ratio between. For each trade made in a margin account, we use all available cash and sweep funds first and then charge the customer the current margin interest rate on the. For example, if a CTA fund with $ million AUM executes trades requiring $25 million in margin, the margin-to-equity ratio is 25%. More conservative managers.

Bmo Bank Money Market Rates

The account earns % APY automatically, with the opportunity to earn up to % APY after bundling the account with a BMO Relationship Checking account. Money Market Account Base rate: %. If balance is $25,–$99, %. If balance is $,–$, %. If balance is $,+: %. View Details -. Savings Builder. BMO Bank Money Market Rates. APY, MIN, MAX, ACCOUNT NAME, VIEW DETAILS. %†, $k, -, Relationship Plus Money Market -. The BMO Harris money market account is available with a minimum opening balance requirement of $5, Your APY rate will depend on where you live, as rates. “BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence. BMO Global Asset Management is a brand name under which BMO. A business money market account is a type of savings account that typically earns higher interest while keeping your money easily accessible. The main. Maximize your money with our high-yield online savings account that offers great interest rates, no fees and no required balance or minimum deposit. At BMO, your money is FDIC insured with both a money market account and a certificate of deposit, offering more security and less risk than other investment. Interest rates earned on the Relationship Plus Money Market Account are based on BMO Relationship Checking Account Relationship Package placement. Initially. The account earns % APY automatically, with the opportunity to earn up to % APY after bundling the account with a BMO Relationship Checking account. Money Market Account Base rate: %. If balance is $25,–$99, %. If balance is $,–$, %. If balance is $,+: %. View Details -. Savings Builder. BMO Bank Money Market Rates. APY, MIN, MAX, ACCOUNT NAME, VIEW DETAILS. %†, $k, -, Relationship Plus Money Market -. The BMO Harris money market account is available with a minimum opening balance requirement of $5, Your APY rate will depend on where you live, as rates. “BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence. BMO Global Asset Management is a brand name under which BMO. A business money market account is a type of savings account that typically earns higher interest while keeping your money easily accessible. The main. Maximize your money with our high-yield online savings account that offers great interest rates, no fees and no required balance or minimum deposit. At BMO, your money is FDIC insured with both a money market account and a certificate of deposit, offering more security and less risk than other investment. Interest rates earned on the Relationship Plus Money Market Account are based on BMO Relationship Checking Account Relationship Package placement. Initially.

While the Northern Bank Direct Money Market Account requires a much higher minimum opening deposit of $, the % APY could make that investment worth it. See deposit product details for accounts including CDs, checking, money market and savings accounts plus reviews, fee information and bank details for BMO. Horrible customer service at the BMO Harris Bank branch at University Parkway and Honore Avenue in Sarasota, Florida. I had a large money market account. Some of the largest Chicago based banks include The Northern Trust Company, BMO Harris Bank and MB Financial Bank. Money Market · Savings Accounts. The average interest rate for a money market account is %. At BMO, you could earn a higher rate when you bundle your Relationship Plus Money Market. % - % APY. Terms of 3 months to 5 years. $1, minimum opening deposit. · Smart Advantage, Smart Money, Relationship ; % to % APY. Terms of 6. BMO Smart Money Checking, None, $25 ; BMO Relationship Checking, %, $25 ; Savings Builder Account, %, $25 ; Relationship Plus Money Market, % to %. BMO Harris Platinum money market account offers an APY starting at % and ranging up to % (APY stands for annual percentage yield, rates may change). At %, the APY on the Relationship Plus Money Market account lags far behind some of the highest rates you can find on MMAs. Also, customers who invest in. Overview of BMO Bank CDs ; Yield (APY). % to % ; Interest schedule. Compounded daily and paid at maturity on three-, six- and nine-month CDs; Compounded. Bankrate provides you with timely news and rate information on the top money market accounts from some of the most popular and largest FDIC banks and NCUA. A money market account is a close cousin to a traditional savings account, but typically offers a higher interest rate and requires a higher balance. by BMO Harris Bank N.A. Member FDIC. This Deposit Account Disclosure and Bank Fee Schedule, the separate Interest Rate Sheet and the Deposit Account Agreement. BMO Money Market Fund ETF Series provides exposure to high-quality money market instruments issued by governments and corporations in Canada. The BMO Alto Online Savings Account offers an APY that's more than 10 times higher than the % national average interest rate for savings accounts. This bank. Headquartered in Chicago, BMO (formerly known as BMO Harris) offers certificates of deposit (CDs) with a range of term options with rates up to %. BMO Government Money Market Fund · 01Ratings · Rating History · 02Rating Actions · 03Insights · Fitch Affirms 'AAAmmf' Ratings on 61 US Money Market Funds; $ Beal Bank. Lake Ave Wilmette, IL % ; BMO Bank. Holland Rd Chicago, IL % ; Chicago Municipal Employees Credit Union. W. Please see below for additional conditions and details of this offer. Accounts are subject to approval and are provided in the United States by BMO Bank N.A. The best money market accounts are offering up to % APY from First Internet Bank and % APY from Vio Bank.

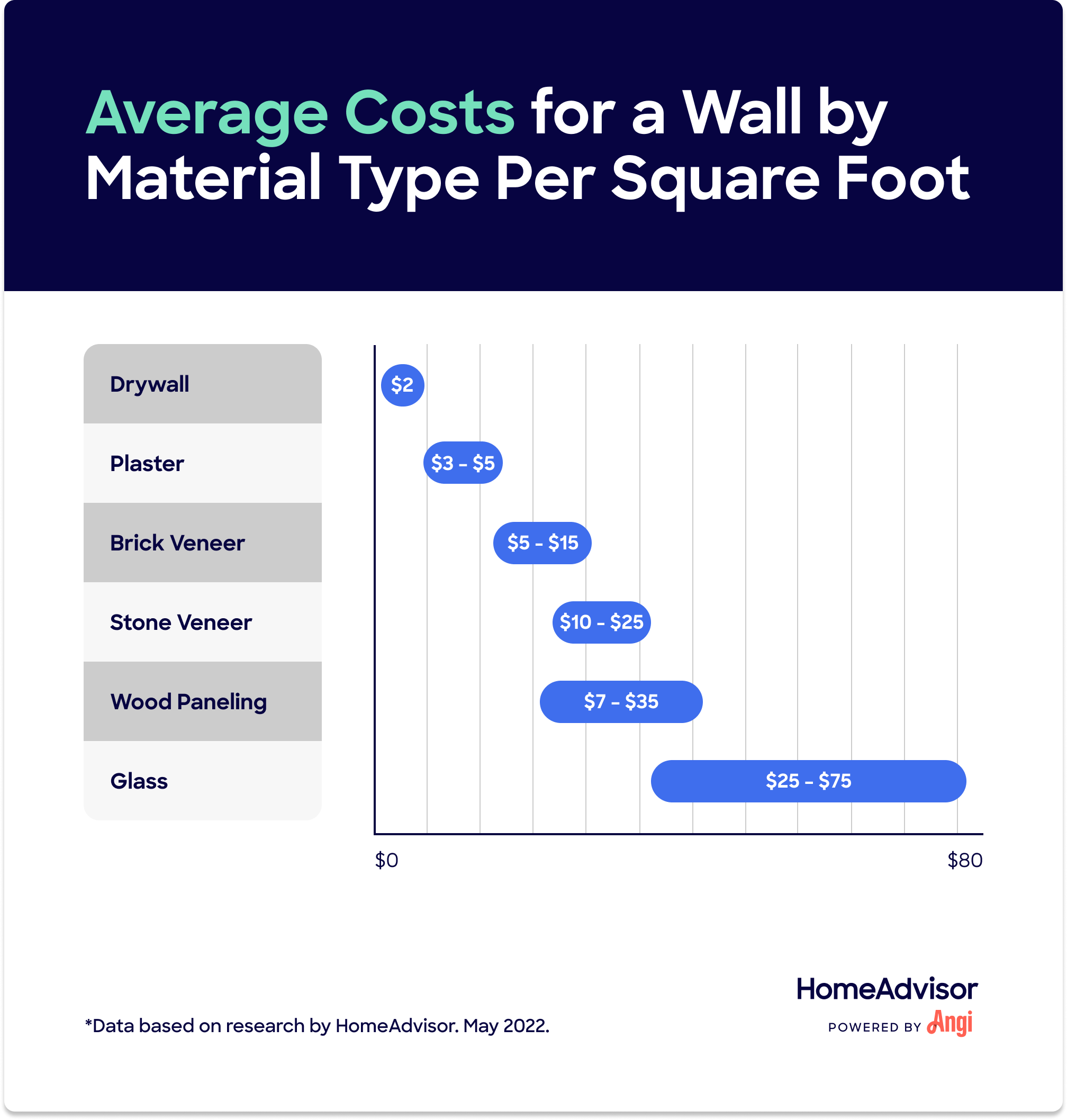

How Much Does It Cost To Build An Interior Wall

Hiring someone to build an L-shaped partition wall 8 feet high and feet long could run $$1, or more for labor and materials depending on the. The first question we typically get asked is, “How much does interior protection of a construction cost? Temporary Construction Walls · Suspended. Cost to Frame an Interior Wall per Square Foot. Framing a wall generally costs $7 to $16 per square foot when installing top and bottom plates with studs. This. Thankfully, if you have decent DIY skills, you can install a partition wall yourself. Below we'll consider the average cost (usually between £ and £) to. The average cost to paint a commercial building · - The going rate for labor is between $55 and $65 per hour · - How many hours will it take to complete my. Building an Interior Wall Frame Most wall framing is done with 2x4 or 2x6 lumber but it may be possible to use 2x3's to build a new, non-load-bearing. The average range is $7 to $16 for residential framing. Labor cost can be $2 to $12 or more per square foot.” That works out to from $9, to. New construction typically costs between $ and $ per square foot, but additions and customizations may quickly inflate the expense to $ or more per. In April the cost to Frame a Wall starts at $ - $ per square foot*. Use our Cost Calculator for cost estimate examples customized to the location. Hiring someone to build an L-shaped partition wall 8 feet high and feet long could run $$1, or more for labor and materials depending on the. The first question we typically get asked is, “How much does interior protection of a construction cost? Temporary Construction Walls · Suspended. Cost to Frame an Interior Wall per Square Foot. Framing a wall generally costs $7 to $16 per square foot when installing top and bottom plates with studs. This. Thankfully, if you have decent DIY skills, you can install a partition wall yourself. Below we'll consider the average cost (usually between £ and £) to. The average cost to paint a commercial building · - The going rate for labor is between $55 and $65 per hour · - How many hours will it take to complete my. Building an Interior Wall Frame Most wall framing is done with 2x4 or 2x6 lumber but it may be possible to use 2x3's to build a new, non-load-bearing. The average range is $7 to $16 for residential framing. Labor cost can be $2 to $12 or more per square foot.” That works out to from $9, to. New construction typically costs between $ and $ per square foot, but additions and customizations may quickly inflate the expense to $ or more per. In April the cost to Frame a Wall starts at $ - $ per square foot*. Use our Cost Calculator for cost estimate examples customized to the location.

Finishing basement walls with drywall costs about $2 per square foot, so the overall cost could range from $ for square feet to $3, for 1, square. Project Overview. Estimated Material Cost: $10/sq ft. Time: Days. kvant-rzn.ru Your door doesn't get attached directly to your wall; it sits within a door frame. How much is the labor cost to install a steel entry door? Installing a. Finishing basement walls with drywall costs about $2 per square foot, so the overall cost could range from $ for square feet to $3, for 1, square. The cost of interior walls framed with drywall can range between $20 to $30 per linear foot. However, this estimate does not include other costs such as drywall. The average cost to frame a house is currently $7–$16 per square foot, including labor. Costs can vary depending on the complexity and size of the home and. RSMeans Data is North America's leading construction estimating database available in a variety of formats. Access accurate and up-to-date building. So, then, how much does it cost to build a custom house? Ballpark figures suggest anywhere between $ to $ per square foot. The large discrepancy. An interior stud wall frame costs around $9 to $16 a kvant-rzn.ru installed. It costs between $ and $ fully installed and finished, making the cost to. The cost to simply tear down a non-load bearing wall would probably be less than $ if it's basic. If it's large and plaster $ If it's. The average price per square foot ranges between $40 and $60, this includes standard finishes for paint, carpet, ceiling tiles, lighting, etc. If you go with. The cost to demo a wall will depend on the type, with non-load-bearing walls running an average of $ to $1, and load-bearing ones costing around $1, to. Your door doesn't get attached directly to your wall; it sits within a door frame. How much is the labor cost to install a steel entry door? Installing a. The average cost for interior designer per room is $1,$12, per room, depending on the city in the United States. How much does it cost to hire an. Interior walls and ceilings usually cost $7 to $16 per square foot. On average, interior wall projects cost $1, Expect additional costs when adding interior. How to Frame a Wall · Shop this Project · Before You Start · Measure Wall Layout · Measure Ceiling · Lay Out the Bottom Plate · Determine Vertical Stud Locations. According to their data, the average per square foot cost for build outs ranges greatly. Some buildings spend $50 per square foot, while others spend well over. The plaster and skim coat mix are calculated for an average room area of about square feet, with plaster and skim coat mix priced at $ and $ per. The plaster and skim coat mix are calculated for an average room area of about square feet, with plaster and skim coat mix priced at $ and $ per.

Where Can I Deposit Change For Cash

:max_bytes(150000):strip_icc()/how-to-fill-out-a-deposit-slip-315429-FINAL-88cd427461ed43c6b5b7fc93d74030d2.png)

Banks will take coins, usually wrapped, from their customers. You might be able to get cash directly or you might have to deposit the money. I. Sorry, we do not accept coin deposits at drive-up branches. However, all of our branch locations have free coin counting machines (up to $ per day) just for. You can buy the paper coin rolls at the dollar store, fill as many as you can up, and then take them into the bank and deposit them into your account. The simplest way to deposit cash into your bank account would be to visit a branch. Bank tellers often have access to automatic coin-counting machines that can. Coinstar lets you transfer coins or cash into your account with ease. Fees vary by Financial Institution. Learn more · Find a kiosk. We would prefer you bring coins into the branch, as sending them through the drive-up tubes may cause mechanical problems. Taking your spare change to the bank to be sorted and applied to your current or savings account balance is one of the most cost-efficient ways to cash in your. BSP Wins Award for Coin Deposit Machine Project · BSP Coin Machines Mark Million Coins Processed · BSP's Coin Deposit Campaign Bags Anvil Silver Award. Coins are legal tender. Banks are required to accept them and deposit in the account. Chase bank policy however is that you can deposit cash. Banks will take coins, usually wrapped, from their customers. You might be able to get cash directly or you might have to deposit the money. I. Sorry, we do not accept coin deposits at drive-up branches. However, all of our branch locations have free coin counting machines (up to $ per day) just for. You can buy the paper coin rolls at the dollar store, fill as many as you can up, and then take them into the bank and deposit them into your account. The simplest way to deposit cash into your bank account would be to visit a branch. Bank tellers often have access to automatic coin-counting machines that can. Coinstar lets you transfer coins or cash into your account with ease. Fees vary by Financial Institution. Learn more · Find a kiosk. We would prefer you bring coins into the branch, as sending them through the drive-up tubes may cause mechanical problems. Taking your spare change to the bank to be sorted and applied to your current or savings account balance is one of the most cost-efficient ways to cash in your. BSP Wins Award for Coin Deposit Machine Project · BSP Coin Machines Mark Million Coins Processed · BSP's Coin Deposit Campaign Bags Anvil Silver Award. Coins are legal tender. Banks are required to accept them and deposit in the account. Chase bank policy however is that you can deposit cash.

Shop Nadex Coins Vinyl 7-Day Pack of Zippered Bank Deposit Cash and Coin Bags with Card Window (Neon colors) in the Cash & Coin Counters department at. You can pay bags of coins into your Nationwide current account or savings account at any of our branches. Here's how we'll need them organised. HESS CoinIn coin deposit systems check, count and value coins around the clock. They cope with large quantities quickly and reliably. Our big green kiosks are at grocery stores, so you can get cash conveniently, right on the spot. A service fee up to % + $ transaction fee may apply. 5 Best Places to Cash Coins for Free · QuikTrip · Bank of America · Wells Fargo · USBank · Select Credit Unions. Banks accept cash. They even have coin counting equipment, but they might not be staffed to handle that for you at the time you choose to go, so. Coin redemption. Coinstar®3 kiosks allow members to deposit or exchange loose change for cash without the hassle of rolling coins. Free service. cash desk of the bank branch or transfer the amount equivalent to the deposited coins to his or her bank account, using the BLIK system functionality. When coins are deposited at a commercial bank, such deposits must follow the Zero value accepted when deposited via cash-in-transit. Banks have the. You can get cash, deposit cash and checks, make transfers between accounts, check account balances and make a payment to your Bank of America credit card. Cash technology solutions for the entire retail cash chain: at the point of A fast, accurate and secure means to automatically return change to customers. Safeguard deposits with Wells Fargo's cash vault services. Get single or batch coin and currency to run your business effectively. 1. Your House · 2. Your Car or Truck · 3. Vending Machines · 4. Drive-Thru Windows · 5. Cash Register Checkout Areas · 6. Coin Operated Car Washes · 7. Coin Operated. Turn spare change into cash quickly with self-service, easy-to-use Coinstar® coin-counting machines. Insured by NCUA. Your savings federally insured to at. Yes, we accept coin deposits via coin counting machines. The machines are available to our members and are located within most of our branches. Most of our branches come equipped with coin counting machines to help you convert your spare change into savings. The best part — our coin counting machines. Children can have fun converting their coin savings into active cash. By automating coin deposits, the need to deposit coins over the counter is reduced and. Branch · Find the nearest Branch using our Locator. · Coin deposit fees is at S$ per pieces or part thereof. · Coins are to be sorted in its respective. Change your loose coins and banknotes at a Post Office near you. Convert coins to notes, notes to coins, or a mixture of both – all for a flat fee. For more information, contact your local Cash office. DO NOT Deposit currency exposed to fentanyl. If you have currency that has been (or is believed to have.

Refinancing Business Loan

Refinancing is when you replace an existing loan with a new loan that pays off the old loan. When you refinance a business loan, you're taking out a new loan. Experienced commercial real estate investors understand the advantages of refinancing and the value of cash flow that allow them to spend less money. Refinancing debt is a good option for businesses who have a high debt load and want to increase cashflow by spending less per month on interest. Refinancing business loans can be a strategic financial move for businesses seeking to optimize their loan terms and improve their financial position. Business debt up to $, may qualify to be fully refinanced in just business days. We also have loan programs to help with refinancing larger debts. Bank refinancing usually permits up to 70% LTV, with some banks going up to 75% for well-qualified borrowers. However, banks also typically offer commercial. Refinancing (or 'business debt consolidation') means consolidating multiple business debts into one, or changing one loan for another. Refinancing is a great option for businesses that wish to increase or decrease the length of their loans. Spread out your repayments over a longer period to. Pursuit offers a variety of small business loans to refinance business debt. Your lender will work with you one-on-one to determine the program that's best for. Refinancing is when you replace an existing loan with a new loan that pays off the old loan. When you refinance a business loan, you're taking out a new loan. Experienced commercial real estate investors understand the advantages of refinancing and the value of cash flow that allow them to spend less money. Refinancing debt is a good option for businesses who have a high debt load and want to increase cashflow by spending less per month on interest. Refinancing business loans can be a strategic financial move for businesses seeking to optimize their loan terms and improve their financial position. Business debt up to $, may qualify to be fully refinanced in just business days. We also have loan programs to help with refinancing larger debts. Bank refinancing usually permits up to 70% LTV, with some banks going up to 75% for well-qualified borrowers. However, banks also typically offer commercial. Refinancing (or 'business debt consolidation') means consolidating multiple business debts into one, or changing one loan for another. Refinancing is a great option for businesses that wish to increase or decrease the length of their loans. Spread out your repayments over a longer period to. Pursuit offers a variety of small business loans to refinance business debt. Your lender will work with you one-on-one to determine the program that's best for.

Refinancing usually involves paying off one commercial loan with the proceeds of another, or extending the maturity date of an existing loan. How to Refinance a Business Loan in 7 Steps · Determine whether you're in a situation to refinance · Determine the refinancing goal · Put together a list of. Expand your business or refinance debt with a loan secured by your choice of collateral. Loan amount: From $25, Interest rate: As low as %Disclosure2 †. How to refinance a business loan in five steps · 1. Determine how much you owe · 2. Set a refinancing goal · 3. Evaluate your qualifications · 4. Research and. refinancing application, we may be able to help CEBA Refinance Program. Financing amount available $20K - $40K. Refinance your Canada Emergency Business. Business refinancing is much like debt consolidation, except instead of taking out a new loan to pay off multiple loans, you only take out one new loan to. Corporate refinancing is the process through which a company reorganizes its financial obligations by replacing or restructuring existing debts. Refinancing existing debt can make changes to your company's debt portfolio in ways that can lead to better credit, greater cash flow, and cleaner books. How to refinance a business loan · Begin by evaluating the terms, interest rates, and repayment structure of your existing loans. · Determine whether. It sounds like you just need to refinance your existing debt, you also may need to consolidate all existing debt. I have helped businesses in a. Refinancing subsequently involves re-evaluating an individual's or a business's credit terms and financial situation. Consumer loans typically considered for. Understand What Refinancing Does Refinancing business loans is not a way to get rid of your debt. It's a way to reduce the debt burden and improve your. An SBA loan is government-backed financing that can be used to refinance debt previously incurred for commercial real estate and fixed-asset projects. The solution: refinance your high-rate business loan with a United Midwest SBA loan up to $, With lower interest rates and a year repayment term, your. CCG provides working capital loans for business-related expenditures that conventional lenders may not be able to offer. Refinancing is a great option for businesses that wish to increase or decrease the length of their loans. Spread out your repayments over a longer period to. How to refinance business debt · Learn whether you could benefit from refinancing · Figure out what debt you plan to refinance · Choose a lender to refinance. Refinancing a business loan can take some effort, but depending on your circumstances, it could be worth it to save you time and money. We offer commercial property loan refinancing for industrial, mixed-use, multifamily, office and retail properties through fixed- and adjustable-rate loan. Why Is Refinancing Through the SBA 7(a) Loan Program Useful? · Take advantage of lower interest rates. · Make lower monthly payments. · Keep your credit quality in.

Fha Mortgage Vs Conventional Mortgage

With a conventional loan, the mortgage insurance requirements are generally stricter than with an FHA loan. The borrower must have better credit scores and a. FHA loans are easier to qualify for, but a conventional loan could save you money in the long run. Author. By Daria Uhlig. Conventional mortgages are not backed by the government the way FHA loans are, so private mortgage holders protect their investments with stricter eligibility. Most conventional loans meet the requirements prescribed by Freddie Mac or Fannie Mae, and you may also refer to the ones that do as conforming loans. For FHA loans, borrowers must pay a % upfront mortgage insurance premium at closing, no matter how large the down payment. The borrower must also continue. Conventional mortgages generally pose fewer hurdles than FHA or VA mortgages, which may take longer to process. Their competitive interest rates and loan terms. For a conventional loan, you are more likely to get a favorable rate if you have an excellent credit record and high FICO score. Conventional loans tend to be better for homebuyers with excellent credit, steady income, and lower debt. FHA loan mortgage insurance is generally more expensive than conventional mortgage insurance because FHA lenders take on more risk approving loans to lower-. With a conventional loan, the mortgage insurance requirements are generally stricter than with an FHA loan. The borrower must have better credit scores and a. FHA loans are easier to qualify for, but a conventional loan could save you money in the long run. Author. By Daria Uhlig. Conventional mortgages are not backed by the government the way FHA loans are, so private mortgage holders protect their investments with stricter eligibility. Most conventional loans meet the requirements prescribed by Freddie Mac or Fannie Mae, and you may also refer to the ones that do as conforming loans. For FHA loans, borrowers must pay a % upfront mortgage insurance premium at closing, no matter how large the down payment. The borrower must also continue. Conventional mortgages generally pose fewer hurdles than FHA or VA mortgages, which may take longer to process. Their competitive interest rates and loan terms. For a conventional loan, you are more likely to get a favorable rate if you have an excellent credit record and high FICO score. Conventional loans tend to be better for homebuyers with excellent credit, steady income, and lower debt. FHA loan mortgage insurance is generally more expensive than conventional mortgage insurance because FHA lenders take on more risk approving loans to lower-.

The primary difference between conventional and FHA mortgages is that FHA loans are designed to make homeownership possible and easier for low- to moderate-. The decision between conventional and FHA mortgages depends on a variety of factors. Conventional loans typically require higher credit scores, larger down. The biggest difference between conventional and FHA loans when it comes to financing options is generally down payment size. Conventional loans require higher. The main drawback of an FHA home loan is that you have to pay MIP no matter what. With a conventional loan, if you put enough money down, you don't have to. The main difference between FHA and conventional is the mortgage insurance. FHA there is an upfront premium of % typically financed into the. FHA loans and conventional loans are popular options among homebuyers. FHA loans come with more relaxed credit score requirements, while conventional loans. Main Difference Between FHA and Conventional Loans · A conventional mortgage product is originated in the private sector, and is not insured by the government. Let's break down the ins and outs of conventional versus FHA loans so you can feel empowered in choosing the right loan for your financial health. While FHA loans are insured by the Federal Housing Administration, conventional loans are not government-insured. This difference has implications for factors. FHA loan interest rates are often competitive with the rates on Conventional loans. You can often get approved for an FHA loan with a smaller down payment and. FHA Loans may have slightly higher interest rates than Conventional Loans; this is because the FHA insures the loan, which adds an additional layer of risk for. FHA Loans vs. Conventional Loans: Which Is Right For You? The biggest difference between these two options is that FHA loans are insured by the Federal. FHA requires % down. Conventional loans require a minimum of 3%. · Mortgage insurance for FHA loans (MIP) is paid in two ways: an upfront. For a conventional loan, you are more likely to get a favorable rate if you have an excellent credit record and high FICO score. From the minimum down payment to the credit score requirements, there is no doubt that FHA loans are easier to qualify for than conventional loans. To. Down Payment: FHA loans require a lower down payment, making them more accessible for first-time homebuyers or those with limited savings. Conventional. FHA loans allow lower credit scores than conventional mortgages do, and are easier to qualify for. Conventional loans allow slightly lower down payments. VA. Confused about FHA vs. Conventional Loans? Don't worry! FHA loans accept low scores of credit and are easy to apply for. Conventional loans have lower down. An FHA loan is designed to ease the path to homeownership for those who may not meet the stricter requirements of a conventional mortgage. Compared to a. FHA mortgages over conventional loans, thanks to lower down payment requirements, better interest rate offerings, and unique refinance loan options.

Invest Fx

Our FX strategists deliver timely trade recommendations and forecasts that help clients mitigate FX risk and optimize investment opportunities. Investing is easy! Decide which product to invest in. Select a PAMM account or portfolio from the ratings. Invest funds and keep track of your returns! Start trading online with an award-winning Canadian broker. Our powerful forex & CFD trading platforms and apps are available on web, desktop and mobile. InvestFX is a licensed FX, stocks, and precious metals online brokerage. . Xchange Invest FX help you to convert your crypto in Fiat for every Brokers. A program to prohibit or require notification of certain types of outbound investments by United States persons into certain entities located in or subject to. How to invest in Forex · 1. Open a brokerage account — First, you need a place to hold your foreign currency. · 2. Fund your account — Deposit cash from a. Investment services at Ally Invest includes Self-Directed Trading, Automated Investing, and Personal Advice products at among the industry's lowest fees. The forex market is traded around the globe, virtually around the clock. Learn more about forex trading with this retail forex guide for beginners. Our FX strategists deliver timely trade recommendations and forecasts that help clients mitigate FX risk and optimize investment opportunities. Investing is easy! Decide which product to invest in. Select a PAMM account or portfolio from the ratings. Invest funds and keep track of your returns! Start trading online with an award-winning Canadian broker. Our powerful forex & CFD trading platforms and apps are available on web, desktop and mobile. InvestFX is a licensed FX, stocks, and precious metals online brokerage. . Xchange Invest FX help you to convert your crypto in Fiat for every Brokers. A program to prohibit or require notification of certain types of outbound investments by United States persons into certain entities located in or subject to. How to invest in Forex · 1. Open a brokerage account — First, you need a place to hold your foreign currency. · 2. Fund your account — Deposit cash from a. Investment services at Ally Invest includes Self-Directed Trading, Automated Investing, and Personal Advice products at among the industry's lowest fees. The forex market is traded around the globe, virtually around the clock. Learn more about forex trading with this retail forex guide for beginners.

FX trading involves trading pairs of currencies and profiting off the price difference between them.

Forex traders (foreign exchange traders) anticipate changes in currency prices and take trading positions in currency pairs on the foreign exchange market. We offer competitive pricing with tight spreads from pips, over 80 forex pairs, fast execution, and multi-platform access. Our FX strategists deliver timely trade recommendations and forecasts that help clients mitigate FX risk and optimize investment opportunities. Forex trading is exchanging one currency for another to profit from the trade. Learn more about trading foreign currencies. Forex News. Keep track of the latest currency market moves as they develop. Stay up-to-date on breaking forex news as well as relevant financial developments. kvant-rzn.ru covers the latest forex news in the currency market and breaking financial news stories. Navigate the complex world of Forex investment with ease using our comprehensive guide. Get expert insights and make sound investment decisions today. Forex trading can allow you to speculate on changes in currency prices in the global market. Forex can also help you diversify your portfolio. About this app. arrow_forward. ☆ Learn stock and forex trading in a friendly, risk-free trading simulator. ☆ Learn Faster. Trade Smarter. And have fun while. "This Euro/dollar deal is guaranteed to rise double what your current investments are doing." Trying to build credibility by claiming to be with a reputable. Forex, FX, or foreign exchange is the trading of foreign currencies. No matter how it might be marketed, Forex trading is complex, volatile, and high risk. We offer forex online trading with tight spreads on all the major and minor currency pairs, nearly 24 hours a day, five days a week. Trade forex pairs using our. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. BlackRock is one of the world's preeminent asset management firms and a premier provider of investment management. Find out more information here. Instantly trade on the go with the user-friendly, award-winning OANDA forex trading app. Trade major and minor forex pairs, such as EUR/USD, USD/CAD. Join senior FX industry leaders from asset management firms, investment banks, corporates, exchanges, hedge funds, insurance firms, pension funds and prime. Invest FX is the best Forex trading course and community on the web. Honest! FX trading at Questrade is for speculation purposes. This means that no physical currency is exchanged as part of the investing process. So, a trader can simply. Payments · Physical commodities · OTC trading · Sales & trading · Risk management · Clearing & custody · Capital markets & advisory · Self-directed investing services. The foreign exchange market assists international trade and investments by enabling currency conversion. For example, it permits a business in the United States.

What Bank Is Right For Me

Will it cost me to transfer money? Many banks don't charge you to pay It's a good idea to check your bank's deposit agreement and any disclosures. me this pop-up of the page I left off on again). You might also be interested in: Introduction; What are advantages of a joint bank account? What are. Which bank account is right for you? Just answer a few questions and we'll help you choose the right bank account for your needs and goals. for intelligent investors. Earn up to % • Increase FDIC coverage • Keep your existing bank. Get Started · Is Max right for me? They are the perfect banking experience, highly recommend for hassle free banking. I did so and this was a very good move for me. Star has had very. Checking vs. Savings Accounts – Which is Best for Me? If you're trying to decide between savings or checking, it's best to consider what you need from your. Alliant Credit Union · Ally Bank · Axos Bank · Bank of America · Bank5Connect · Barclays · Bethpage Federal Credit Union · Bread Financial. Closing checking accounts in good standing also won't impact your credit score. However, overdrawn checking accounts may appear on your credit report if you don. Choose the best account for you and enjoy Online Banking, Mobile Banking Footnote[1], a debit card with Total Security Protection ® - and much more. Will it cost me to transfer money? Many banks don't charge you to pay It's a good idea to check your bank's deposit agreement and any disclosures. me this pop-up of the page I left off on again). You might also be interested in: Introduction; What are advantages of a joint bank account? What are. Which bank account is right for you? Just answer a few questions and we'll help you choose the right bank account for your needs and goals. for intelligent investors. Earn up to % • Increase FDIC coverage • Keep your existing bank. Get Started · Is Max right for me? They are the perfect banking experience, highly recommend for hassle free banking. I did so and this was a very good move for me. Star has had very. Checking vs. Savings Accounts – Which is Best for Me? If you're trying to decide between savings or checking, it's best to consider what you need from your. Alliant Credit Union · Ally Bank · Axos Bank · Bank of America · Bank5Connect · Barclays · Bethpage Federal Credit Union · Bread Financial. Closing checking accounts in good standing also won't impact your credit score. However, overdrawn checking accounts may appear on your credit report if you don. Choose the best account for you and enjoy Online Banking, Mobile Banking Footnote[1], a debit card with Total Security Protection ® - and much more.

Local credit unions are almost universally better than big banks for most day to day banking.

Better Money Habits has resources on navigating your finances. Learn more You must be enrolled in Online Banking or Mobile Banking to participate. Find the best checking account for your finances with Fifth Third Bank. Compare free checking accounts and apply here. Clear Access Banking · Best for · No $5 monthly service fee charged for · Features. CIT Bank named Best Online Savings Account and Best High-Yield Savings Account by The Ascent, a Motley Fool service · Bank. Find the right savings or eChecking. pay in a minimum amount every month; have a good credit history; own a smartphone; switch an existing account to qualify. Banks will also need to verify who you. Compare U.S. Bank checking accounts to find which one is right for you. Get ATM access, pay bills, bank online and more. Apply in minutes. Me Find a Branch/ATM · Schedule an Appointment · Download Mobile App · Report a How the Right Banking Partner Can Help You Build and Expand Your Business. Banking · The best products and services · Savings Accounts · CDs · Checking Accounts · faq · Expert reviews · Popular articles · Latest coverage. First State Bank offers checking accounts, savings accounts, mortgages, home loans and more in OH and KY. Explore our products and banking services online. choose the right type of account for your lifestyle. Not a customer yet A bank account number helps identify your account and can be found multiple ways. Which Capital One bank account is right for me? It depends. Most people choose a Capital One bank account based on their lifestyle and goals. A checking account. Named on Forbes list of World's Best Banks in Best Companies to Work For NH. Best Companies to Work For in New Hampshire. Best Places to Work in ME. girl on bridge mobile banking. What checking account is right for me? Your financial goals are too important for a one-size-fits-all checking account. right from our Mobile Banking app. Zelle Sizzle Video layer Show me how to send money with Zelle in Mobile BankingShow me how to send. girl on bridge mobile banking. What checking account is right for me? Your financial goals are too important for a one-size-fits-all checking account. Is a HELOC or Second Mortgage Right for Me? Despite their name, you can do more than simply write checks with a checking account. Today, banking with a. MidFirst Bank makes banking easy with mobile banking and its flexible money management tools. Learn more. Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today. true xf false. true xf false. Contact Us. Let's Meet. Review your calendar and Eligible PNC Bank account and PNC Bank Online Banking required. Certain. Which Online Bank Account Is Best for Me? Find out what to look for when choosing between a CD, high-yield savings account and mileage savings account from.

How To Live On A Tight Budget

It all starts with understanding where your money goes. If you don't have a budget plan, your first step should be to create one. These simple tips and budgeting tricks can help you get by while living on a tight budget so you can improve your finance situation. Do you often feel like your budget is TIGHT? Learn how to live below your means on a tight budget by mastering your expenses and budgeting. If you always live like you're broke, you'll have money left over in the end. Even if you CAN afford to go out to a nice dinner tonight, save that money for. 12 tips to organize your tight monthly budget · Stay single. · Don't celebrate your birthday with big party and long guest list. · Learn to walk more. · Uninstall. Guide to Tight Budgeting: 11 Strategies · 1. Getting Honest With Your Budget · 2. Finding Ways to Save · 3. Negotiating With Service Providers · 4. Cutting Back on. 1. Figure out your total income for a month. Before you can decide how to divide up your budget, you'll have to know exactly how much money you'll have. How to start living a frugal lifestyle? · Set financial goals: Identify your financial goals, and make a plan to achieve them. · Create a budget: Creating a. Work and hobbies. Exercise. Living life cheaply. Books from library on Kindle. Audiobooks. Movies (TubiTV, etc), music, writing, phone. It all starts with understanding where your money goes. If you don't have a budget plan, your first step should be to create one. These simple tips and budgeting tricks can help you get by while living on a tight budget so you can improve your finance situation. Do you often feel like your budget is TIGHT? Learn how to live below your means on a tight budget by mastering your expenses and budgeting. If you always live like you're broke, you'll have money left over in the end. Even if you CAN afford to go out to a nice dinner tonight, save that money for. 12 tips to organize your tight monthly budget · Stay single. · Don't celebrate your birthday with big party and long guest list. · Learn to walk more. · Uninstall. Guide to Tight Budgeting: 11 Strategies · 1. Getting Honest With Your Budget · 2. Finding Ways to Save · 3. Negotiating With Service Providers · 4. Cutting Back on. 1. Figure out your total income for a month. Before you can decide how to divide up your budget, you'll have to know exactly how much money you'll have. How to start living a frugal lifestyle? · Set financial goals: Identify your financial goals, and make a plan to achieve them. · Create a budget: Creating a. Work and hobbies. Exercise. Living life cheaply. Books from library on Kindle. Audiobooks. Movies (TubiTV, etc), music, writing, phone.

Living on a budget can be a hard lesson to learn. Take it from our "How to Deal" columnist, who had to deal with a few “low balance” warnings in the early. 1. Set A Grocery Budget · 2. Always Plan Your Meals · 3. Shop From The Back · 4. Cancel Your Gym Membership · 5. Compromise On Cheaper Haircuts · 6. Sign Up For A. Make a sensible budget and stick to it · Give yourself a little room · Don't change your lifestyle completely · Learn to cook · Don't hide your budget · The bottom. 18 easy ways to save money on a tight budget · 1. Set a budget and review it regularly · 2. Save money on your food shop · 3. Reduce your motoring costs · 4. Keep. 12 tips to organize your tight monthly budget · Stay single. · Don't celebrate your birthday with big party and long guest list. · Learn to walk more. · Uninstall. 1. Figure out your total income for a month. Before you can decide how to divide up your budget, you'll have to know exactly how much money you'll have. How to start living below your means · The 50/50 Rule · Track your spending · Create a family budget · Work together as a couple. 1. Set A Grocery Budget · 2. Always Plan Your Meals · 3. Shop From The Back · 4. Cancel Your Gym Membership · 5. Compromise On Cheaper Haircuts · 6. Sign Up For A. Educate yourself on smarter ways to improve your budget and apply GOBankingRates' money-saving tips to your life to start building your savings account. Make. Living on a tight budget means that you have to give up some of life's niceties, but if you do things right, you don't have to give up all of them. 10 Unexpected Tips for Saving Money on a Tight Budget · 1. Shift Your Electricity Use · 2. Check Your Eligibility for Low-Income Utility Programs · 3. Search. Tips for moving and living on a very tight budget?? · Keep your AC as close to the outside temperature as you can possibly bare. · If you don't. How to Survive on a Tight Budget · 1. Make a Budget · 2. Be Realistic · 3. Try DIY · 4. Think About a Side Hustle · 5. Control Your Credit Cards. Single people's budgets are stretched more than ever thanks to the singles tax — here's how to save more money ; Mint · Cost · Standout features · Categorizes your. Low maintenance because I can literally clean the RV in 30 minutes, when I have to clean our house, I feel like there is never an end to it. By the time I. Introduction: Living comfortably on a tight budget is a goal many individuals strive to achieve. Financial constraints shouldn't dictate. How to start living below your means · The 50/50 Rule · Track your spending · Create a family budget · Work together as a couple. How to Stay Positive When Living on a Tight Budget · 1. Remember Your Why. What is your reason for living on a tight budget? · 2. Make Frugal Fun! Look around. Audit your expenses. Set aside time when you're feeling good to print off and review your bank and credit card statements. Or use a budget app. Carefully review. Eating healthy on a budget can start at home or in the grocery store. Try meal prepping, getting your groceries when you're not hungry, and more.

How Much Real Diamonds Cost

We are very competitive in our valuations, but many factors go into pricing specific diamonds. This original Diamond Price Calculator™️ has been relied upon by. Even for a 1 carat diamond, it ranges from $ to $ as we see in a quick search on James Allen, but for real, how much is a diamond worth in average? Is. On average, diamond buyers can expect to pay anywhere from $ to $ AUD for a 2-carat diamond. This will vary greatly when taking into consideration the. Lab-Grown Diamonds are chemically, physically and optically identical to natural diamond. So how much DOES a 1-carat diamond cost? Okay, so let's get down to. Thus 1-carat diamond price will be approximately INR which will vary according to the Diamond quality. Note: The primary source of diamond price. Natural diamonds in colors such as blue and pink are extremely rare and command very high prices. Lab-created diamonds in these colors cost thousands of dollars. For example, an expensive 1 carat D color IF clarity diamond can cost over $20, while a 1 carat K color SI2 clarity diamond currently costs closer to $2, diamonds under 4ct never rose as much nor fell as far. The source is real live market data, as the prices of most of these diamonds are set by Business to. We'd say somewhere between US $ and $ per carat. That's what manufacturers pay for diamonds in bulk to be used for industrial purposes. We are very competitive in our valuations, but many factors go into pricing specific diamonds. This original Diamond Price Calculator™️ has been relied upon by. Even for a 1 carat diamond, it ranges from $ to $ as we see in a quick search on James Allen, but for real, how much is a diamond worth in average? Is. On average, diamond buyers can expect to pay anywhere from $ to $ AUD for a 2-carat diamond. This will vary greatly when taking into consideration the. Lab-Grown Diamonds are chemically, physically and optically identical to natural diamond. So how much DOES a 1-carat diamond cost? Okay, so let's get down to. Thus 1-carat diamond price will be approximately INR which will vary according to the Diamond quality. Note: The primary source of diamond price. Natural diamonds in colors such as blue and pink are extremely rare and command very high prices. Lab-created diamonds in these colors cost thousands of dollars. For example, an expensive 1 carat D color IF clarity diamond can cost over $20, while a 1 carat K color SI2 clarity diamond currently costs closer to $2, diamonds under 4ct never rose as much nor fell as far. The source is real live market data, as the prices of most of these diamonds are set by Business to. We'd say somewhere between US $ and $ per carat. That's what manufacturers pay for diamonds in bulk to be used for industrial purposes.

That said, it is important to remember just how many livelihoods ethically-established diamond mines can support in mining-dependent communities. The cost of a. 4 Carat Diamond Prices A realistic starting budget for a 4-carat diamond would be $50, This J-VS2 round brilliant round brilliant is a good base point and. Discover a large selection of over + Round cut, GIA certified, natural diamonds. Design your dream engagement ring with Diamond Mansion Round Cut. Diamond is one of the most expensive gemstones. Diamond prices can be around $ - $ per carat. The following is an illustration of Diamond. 34k for a carat, earth mined, IF diamond is a great price. But who would want it even for that price with a heavy brown hue and strong. When shopping for a diamond, you could probably get yourself a nice one-carat Lab Grown diamond for around $1, to $8, Naturally-mined diamonds, on the. Prices per stone for Rounds — (ct) diamonds ; ct. Choose from — carat · CT — ⌀MM ; ct. Choose from — carat · CT —. Why are the results such a big range? ; Loose Diamond Weight, Starting Price ; 1/2 Carat, $1, ; 3/4 Carat, $2, ; 1 Carat, $4, ; 1 1/4 Carat, $6, Diamonds have a set international market price, unlike other gems. In this respect, diamond is somewhat like gold. However, diamond pricing is much more. This is evident when you look at the average retail prices of diamonds by carat weight. On average, the retail price for one carat diamonds can be anywhere. While seemingly identical, these stones currently trade between $6, to $10, This is a staggering difference, and as the diamond gets larger, this price. natural ct $, | lab grown ct $1,, One to one-and-a-quarter-carat diamonds are available in many shapes and qualities. Cut. Three-quarter to one carat diamonds are available in many shapes and qualities. Average cost for a well cut round brilliant diamond SI1-VS2 clarity and F-G-H. The higher cut, colour, clarity and carat weight, the rarer the stones and therefore the greater the value of diamonds. Diamond prices increase exponentially. This is evident when you look at the average retail prices of diamonds by carat weight. On average, the retail price for one carat diamonds can be anywhere. Gem quality diamonds are much more valuable. Price is determined by Cut, Colour, Clarity and Carat Weight. Small stones ( carats) of low. How is the price of diamonds calculated? The cut of the diamond; The carat weight; The color of the diamond; The clarity of the diamond. What other criteria can. Natural Diamond · ct Marquise Shape · Excellent Cut · D Color HPHT · IF Clarity · GIA Certificate · $90, - $, So how much DOES a 1-carat diamond cost? Okay, so let's get down to the real diamond, you have another option to consider: Diamond 'LG'. Cut. In natural diamond pricing, the price goes up exponentially when a larger weight is combined with high-quality cut, color and clarity as this increases a.

1 2 3 4 5